The Luxury Report – Understanding the luxury residential market and priorities of HNWI clients

Coming out of a global pandemic, people’s priorities and lifestyles have changed drastically. While some trends were reactive to the circumstances, some served to amplify trends already beginning to show before 2020.

The luxury market, in particular, is prone to rapid changes and shifting priorities for clients, posing a real challenge for real estate developers and the design/build community aiming to market their services toward this audience. Because of the ever-evolving nature of the luxury residential market, we created The Luxury Report, which aims to bring leaders in the luxury residential market into our space to help break down the new trends and what they mean to those serving high-net-worth individuals.

Planeta Design Group

Event Recap

On the morning of June 14th, 2023, TSP Smart Spaces welcomed over 40 guests in the Boston architecture and design, and builder community into our Experience Lab for a talk on understanding the luxury real estate market and the priorities of HNWI clients who purchase luxury properties. After a delicious breakfast and some much-needed coffee, Rhiannon Hayes, Director of Business Development at TSP Smart Spaces, kicked off the discussion by introducing our featured guests: Ricardo Rodriguez, Global Ambassador for Coldwell Banker, and Patrick Planeta, Principal of Planeta Design Group. Ricardo and Patrick are leaders in the Boston community and are well respected globally for their work in luxury real estate.

Patrick is the Principal of Planeta Design Group, but his reputation goes beyond leading one of Boston’s premier design firms. Patrick was among the first to receive New England Home’s prestigious ‘5 Under 40’ award and served on the Board of Directors of Artists for Humanity. In addition, he is committed to the Board of Directors at MSPCA – Angell Hospital and co-chairs the Acquisitions Circle at ICA Boston. His work in architectural interior design and Fine Arts Advisory has made him one of Boston’s most respected design and build community leaders.

Ricardo Rodriguez has a similar reputation for excellence, with decades of experience in the Boston luxury real estate market. A true American success story, Ricardo came to the United States with $25 in his pocket and has risen to become Coldwell Banker Realty’s Global Luxury Ambassador. His work in the industry has earned him various accolades, including NAHREP’s #1 Latino Agent in the US, Wall Street Journal’s Top 100 Teams in the US, and Boston Magazine’s Best Real Estate Agent.

While the main focus of the discussion was on the shifting needs and lifestyles of the luxury residential market, the hour-long talk touched on everything from wealth migration to how luxury clients are adjusting to a post-pandemic world. The event was brought to life by TSP’s own Rhiannon Hayes, who envisioned the event as a way to bring experts in the industry together to share knowledge and experiences, as well as an opportunity for the design and build community to come together and foster new connections. TSP’s goal is to be a resource for our residential community, and by hosting events featuring industry experts, we can help share their knowledge.

“Many people in the residential real estate market would like to focus on luxury clientele. So this business experience is about sharing knowledge everyone can benefit from.” – Rhiannon Hayes.

Luxury Trends in a Post-Pandemic World

Geographic Shifts and Wealth Migration

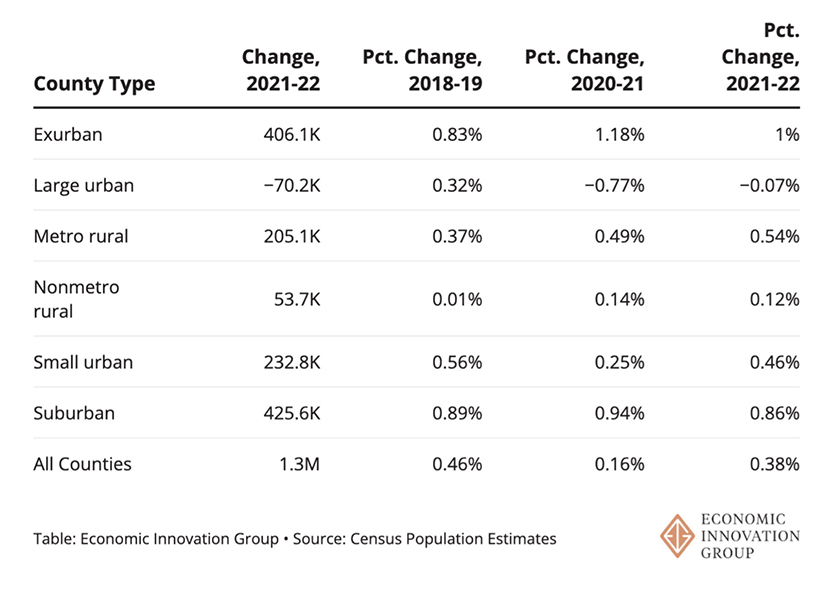

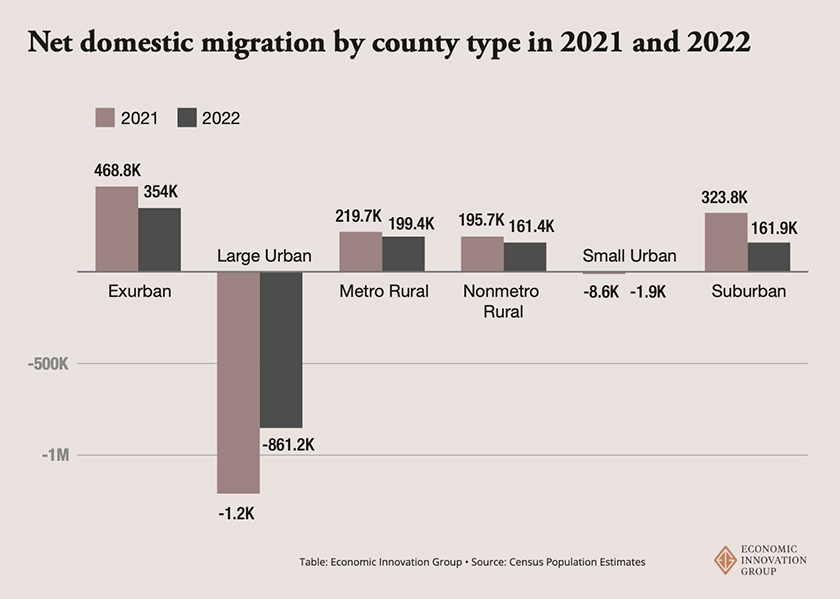

Coming out of Covid, much of the conversation has been around geographic movement. You hear it all the time. People are moving out of the cities and into the suburbs, or from the more expensive cities to more affordable ones. Whether this has stemmed from a realignment in people’s values, more flexibility in people’s professional lives, or a combination of both, this trend continues to happen across the United States.

“Two million people fled America’s largest cities from 2020 to 2022, new research shows, signaling a retreat from urban centers to suburbs, exurbs, and smaller cities,” according to a new report from the Economic Innovation Group. (1)

While this shift has gone largely unnoticed in Boston, it is witnessing a significant wealth migration. Right now, wealth is in the hands of people younger than you would expect. The parents planning to pass down wealth in the next 10-20 years are passing along wealth now, a likely after-effect of the Covid-19 pandemic. With more accessible wealth in the hands of younger generations, the luxury residential market has changed, particularly in real estate.

A Shift Away from Emotional Purchasing

Real estate has historically been an emotional investment.

Previous generations spent their wealth on homes they had an emotional connection to or a connection to an architectural or design interest. Today’s generation views their investments as more transactional and less based on personal interests or emotions. Properties and similar assets are purchased with the intent to flip them and make a profit. This has also led to a greater diversification of investment portfolios. Where the previous generation may have purchased a $20 Million home on Cape Cod, investors now often want smaller homes across multiple cities, such as four $5 Million condominiums in four popular cities. This focus on ROI and potential earnings has shifted how luxury real estate approaches selling. The sale is less focused on how the home fits the lifestyle of the interested party and more on how their investment will return money over time. It’s also about a lifestyle that is flexible and offers different experiences.

“The previous generation would come to us and say, ‘I want the biggest house, the most waterfront, the most expensive house.’ Today it’s different. They’re allocating their investment across multiple properties” – Ricardo Rodriguez.

Despite these shifts, real estate remains one of the most stable investment forms, particularly among those with high-level portfolios. A significant reason for this is the continued growth of the international movement to and investing in luxury real estate in the United States. From 2013 to 2018, the number of HNWIs moving internationally more than doubled, and this trend has continued into 2023 with a record-setting 125,000 HNWI moves projected. (2)

The Growing Responsibilities of a Family Office

High-Net-Worth-Individuals – A high-net-worth individual (HNWI) is a financial industry classification for a person with over $1 million liquid assets. The United States has a record number of HNWIs at 7.46 million. An ultra-high-net-worth individual has a net worth of more than $30 million. (3)

Another shift in how HNWIs operate is the growth of the family office and their involvement in real estate investing. For those unfamiliar with the concept of a “family office,” they are a privately held company that manages investment portfolios, legal and insurance needs, management assets, and oversight for the client’s lifestyle, primarily for high-net-worth individuals and families. This is generally reserved for those with over $50 million in investable assets.

Today, developers and agents work more directly with family office staff than with luxury clientele. Where family offices used to operate more in an advisory capacity for individual investments, in recent years, they’ve taken a more active role in investment guidance for everything from real estate to fine art and jewelry.

“Selling to high-net-worth individuals has become an art form. Often, you get very little or no time with the client. You’re talking with a third party (family office) to transfer information, and you don’t quite know what is making it back to the owner. You must communicate clearly and effectively to ensure the information is being translated correctly to the client.” – Patrick Planeta.

A Fresh Start

One consistency seen everywhere since the end of Covid: people are ready for change. They’ve been in the same homes for years and had their lives on pause since 2020. Now that the pandemic is over, they’re ready to change things and start fresh again; even for those who aren’t following the trend of leaving cities, people are changing neighborhoods or moving across the street to get a new view. Whether luxury clients are moving, wanting a change, or are simply looking for their next investment, the opportunities are out there.

Lifestyle Focused on Wellness and Security

A direct result of the Covid-19 pandemic is a lifestyle shift towards wellness and security. This goes beyond simply making healthier decisions and protecting yourself. People are now integrating health and safety into their lifestyles, investing in amenities that focus on these values. We’re not seeing this as a trend of the pandemic only. It is a trend that continues to grow. Luxury clientele, in particular, are investing more heavily in properties that feature art studios, yoga rooms, smart entry systems, and more.

For example, Ricardo spoke about the luxury properties at 566 Columbus in Boston he’s been working closely with. These properties feature luxury design and a coveted location in an expensive neighborhood. Still, the most significant selling points have been the wellness amenities such as the outdoor gym, rooftop yoga deck, and pet spa. TSP Smart Spaces has also been working with the building owners to offer home technology solutions for tenants, something Ricardo mentions is a big thing in homes today.

“Technology has become really, really important in homes. Particularly if you’re looking at people with multiple homes… you now have the ability to keep an eye on them and control them centrally.” – Ricardo Rodriguez

Ricardo Rodriguez & Associates

Luxury in Boston

While the luxury residential market trends across the country are mirrored in Boston, Boston has its own luxury market with its own unique flairs. Patrick says, “Boston has a different luxury lifestyle than other cities. Here, people want quiet luxury, comfort, and health.” Boston has a lot of wealth, but it’s quiet wealth, more of a subdued luxury. It’s still luxury, but not flashy or ostentatious like you may see in Miami or Los Angeles. Patrick also remarked that sustainability is essential everywhere but particularly important for Boston clientele. Homeowners care more about environmental impact, and their home’s sustainability becomes a point of pride among HNWIs.

Adjusting Your Strategy to Keep Up

With all of these changes in the luxury market happening quickly, how can you keep up? How can you ensure you and your organization aren’t left behind or lose touch with the luxury market? Ricardo and Patrick offered a few strategies to keep up with the luxury residential market.

1. Geographic Expansion

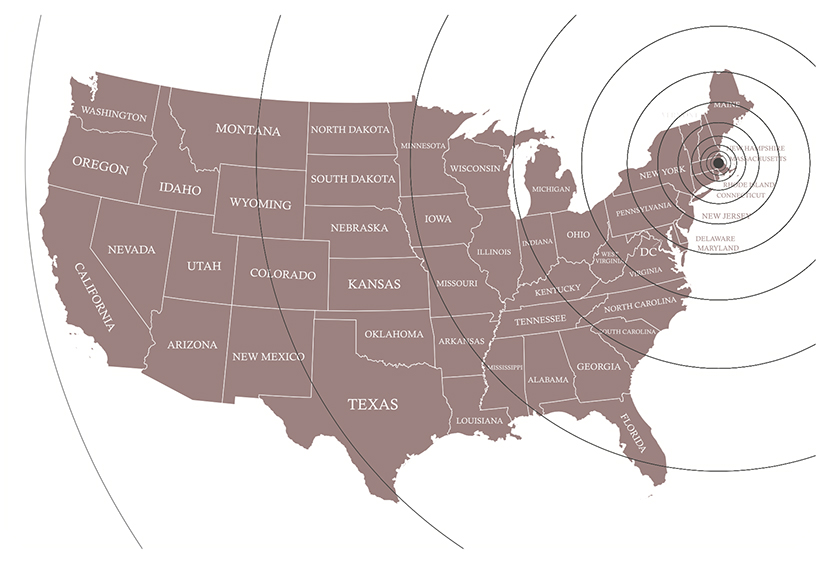

With the younger generations adopting a more flexible lifestyle and purchasing multiple homes across a wider geographic area, it’s essential to broaden your market beyond the scope of your immediate area. Previously, clients might need to be in Boston, NY, or LA. They needed to be in one of these Mecca centers because that’s where the business is. That’s where the wealth is. Now, with people being more transient, clients are looking for second and even third and fourth homes outside of the city they live in, so investors are going towards developers exploring those areas. For Ricardo, this meant expanding his coverage to include Providence, Newport, and even north to New Hampshire and Maine.

Ricardo stressed the importance of making friendships with those outside your current market. This doesn’t mean having a realtor in other cities you can send your clients to. This means finding others who have the same ethos and style as you. The same values and focuses. When your clients are looking for properties or investments outside your market, you can trust that where you’re sending them, they’re getting the same level of service and offerings they’re used to.

2. Vendor Relationships

Knowing who you’re working with and trusting in their products and services has become incredibly important. Patrick remarked how he had been working in the luxury residential market for over 25 years, and Covid showed him more than ever who he could rely on and couldn’t from a vendor perspective. Covid accelerated the schedule people have and expect for projects. People used to go to the office every day and weren’t in their homes as often. Now they are in their homes more regularly, and their expectations for how quickly projects should get done have grown.

The breakneck speeds at which everything has to be done put a lot of strain on business relationships and make picking the right vendors and partners crucial to the success of any project. Patrick remarked, “Working with this caliber of client, there’s less room for errors and delays.” You need to trust your vendors and partners and know they will help move the project forward, not hold it back due to poor service or supply chain issues.

3. Value Alignment

A proven relationship-development strategy is to align your business with the values of your clientele. No matter what industry you are in, showing that you are aware of your sustainability footprint and reducing your environmental impact will go a long way with HNWI clients. However, stay away from “greenwashing” by using frameworks like B Corp that show third-party validation of your sustainability credentials.

Similarly, show that you’re committed to your client’s interests in security, wellness, and technology by ensuring that your service offerings and go-to-market strategies include a holistic approach to address their longer-term concerns. Even if you are providing a niche service, partnering with other similarly-aligned vendors lets you communicate that you understand the larger picture of what matters to them.

Aligning yourself with the values of your clientele has always been an effective strategy, but doing so in a way that demonstrates authentic commitment is especially important for these highly educated, business-savvy, and successful clients.

About Ricardo Rodriguez

About Ricardo Rodriguez

Ricardo Rodriquez, Coldwell Banker Global Luxury Ambassador and Principal at Ricardo Rodriguez & Associates for Coldwell Banker Realty

With more than 16 years of experience, Ricardo Rodriguez is an award-winning realtor with Coldwell Banker Realty in Boston. Born in Colombia, Ricardo immigrated to the United States with $25 in his pocket and taught himself to speak English. Through partnerships, creativity, and a stellar work ethic & dedication, he has become one of the most accomplished agents in the Coldwell Banker network.

About Patrick Planeta

About Patrick Planeta

Patrick Planeta, Principal at Planeta Design Group

Celebrating almost 25 years in the industry, Patrick is the principal and owner of Planeta Design Group, a multidisciplinary architectural interior design firm headquartered in the South End neighborhood of Boston, MA. He is known for his passionate, immersive, and detail-driven work that yields fresh, inviting, creative designs in residential and commercial development. In addition to his design work, he also passionately helps clients collect contemporary works through his art advisory and personal collecting knowledge.

About TSP Smart Spaces

Our work in home automation and technology architecture began when a longstanding client, frustrated by the smart home technologists and integrators creating sub-par solutions for his own home, issued us a simple challenge: “Do better.” So we did. Leveraging our 27 years of strategic technology development and implementation, a diverse team of specialists based in Boston MA, and a long-standing commitment to innovative, bespoke, design-informed solutions, TSP looks beyond tired industry-standard approaches to home automation. Instead of filling a space with obtrusive, overpriced and inadequately maintained tech, we focus on simplicity, seamless interaction, remote monitoring, reliability, and most importantly, a flawless user experience.

Sources –

- Ozimek, Adam, and Connor O’Brien. “As Major Cities Struggle to Rebound, Remote Work Continues to Shift Population Growth.” Economic Innovation Group, 5 Apr. 2023, eig.org/2022-county-population-trends/. Accessed 20 Jun. 2023.

- Shaw, Elizabeth. “Millionaire Migration Rise and Heads to New Destinations.” Migration Policy Institute, 10 Nov. 2022, www.migrationpolicy.org/article/millionaire-migration-rising. Accessed 20 Jun. 2023.

- Hayes, Adam. “High-Net-Worth Individual (HNWI): Criteria and Example.” Investopedia, 1 Jun. 2023, www.investopedia.com/terms/h/hnwi.asp. Accessed 20 Jun. 2023.

- Rodriguez, Ricardo and Planeta, Patrick. “Understanding the Luxury Market and Priorities of HNWI Clients.” The Luxury Report, TSP Smart Spaces, 14 Jun. 2023, 500 Harrison Ave., Boston, MA. Invited talk.